52% of Employers Offer High-Deductible Health Insurance Plans

In order to boost the use of these high-deductible health insurance plans, employers are providing more support to workers to educate them on their health coverage options.

Despite the fact that the health insurance exchanges and Medicaid expansion opened up more opportunities for Americans to obtain healthcare coverage without being dependent on employment, the health payer industry is still intertwined with the insurance plans offered through employers. As such, when payers are attempting to position new payment models and innovative solutions through their health insurance plans, bringing employers to the table could be beneficial for all.

Earlier this month, at the Healthcare Financial Management Association (HFMA) National Payment Innovation Summit, Dr. Robert Galvin, MBA, MD, CEO at Equity Healthcare, discussed the importance of involving the employer perspective when creating health insurance plans and other payment reforms throughout the health payer industry.

gI want to talk about why the folks involved in payment reform should care what employers think. Benefit design is moving in a direction that isnft compatible with payment reform. Commercial payers are important [when it comes to benefit design],h Galvin began.

gWhy should any provider care about the employers since they never see employers and never hear about employers? eWhy should I care?f payers and providers consider,h continued Galvin.

gI think the reason is that we are the voice behind the insurers. Itfs really not their money that theyfre using. Itfs the employersf and employeesf money that payers are using.h

gPayers could innovate with GE or other major employers. [Medicare and federal agencies] have a theory of what they want to do and if itfs not where you want to go, you can work with employers,h explained Galvin.

gThrough employers is how the workers get all their benefits. It is how employees and their kids get benefits.h

Competitive health coverage important to employees

Itfs important for payers to remember that health insurance plans and benefits are also very important to employees. A survey from Harris Poll initiated by the software business Collective Health illustrated that more than three-quarters of respondents believe that healthcare coverage options are the main stimulus for their workplace decisions.

The survey polled more than 2,000 employees about health insurance plans and employer-sponsored healthcare benefits. Out of all respondents who have employer-sponsored coverage, 86 percent felt that competitive benefits would be a real benefit to choosing a certain job.

The results also show that 57 percent would not accept a job offer without competitive healthcare benefits and 78 percent said theyfd put healthcare benefits under sincere consideration when choosing a job.

The company Benefitfocus released a report that details some of the changes taking place in employer-sponsored health insurance plans due to the reforms created by the Patient Protection and Affordable Care Act.

How high-deductible health plans are affecting the workplace

The researchers from Benefitfocus looked at enrollment data from 500 large companies to determine how employers are incentivizing employee retention through healthcare coverage. The report shows that 52 percent of employers offer a minimum of one high-deductible health insurance plan.

Even though HMOs and PPOs remain the dominant types of health coverage plans, more employers are now offering low-cost options like high-deductible plans. Additionally, 41 percent of employees are choosing these high-deductible plans instead of more typical health insurance plans like HMOs and PPOs, the report found.

Out of the employees who are choosing these high deductible health insurance plans, the majority are younger with millennials taking up the highest portion of the workers.

gHDHP [high-deductible health plan] adoption rates were highest for millennials, at approximately 44 percent, and decreased with each older generation, bottoming out at 22 percent for traditionalists. This could simply be the result of familiarity – HDHPs are less of a novelty for millennials, while traditionalists might be more reluctant to change – or of income – millennials presumably earn less than older generations and therefore choose to spend less on premiums,h the report stated.

gOr it could be that these millennials recognized their relatively low risk of needing extensive health care and understood the HDHP — essentially catastrophic health insurance — to be their most cost-effective option. Meanwhile, with health risk typically increasing with age, the older generations would be more inclined to see copay-based traditional plans as the most cost-effective route.h

The report also uncovered that the biggest companies have the right monetary numbers needed to avoid the Affordable Care Actfs Cadillac Tax, which goes into effect in 2020.

gThis report marks a new era in employee benefits. With sophisticated enterprise benefits management systems like the Benefitfocus Platform, we can now draw meaningful insights from actual employee behavior,h Shawn Jenkins, Benefitfocus CEO, said in a public statement. gThis is a quantum leap forward for CHROs, CFOs, administrators and all of us working to turn benefits into a strategic asset. This report provides a road map for policymakers looking to expand health care coverage while controlling costs.h

Voluntary benefits are being offered in low numbers with a mere 36 percent of employers providing accident, critical illness, or hospital indemnity insurance in 2016 while only 14 percent of workers enrolling in these particular coverage plans.

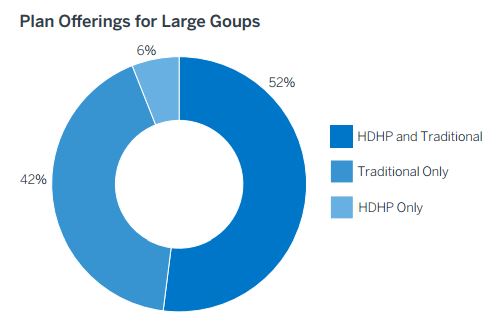

The results show that while 52 percent of employers offer traditional health plans and high-deductible plans, 42 percent offer only HMOs and PPOs and 6 percent of employers have just the high-deductible coverage offerings.

The report also mentions that, as more employees seek cost-cutting strategies and methods to lower premium prices, the popularity of high-deductible plans may go up. As the popularity of these health insurance plans increases, gfull replacement offeringsh among employers is expected to rise.

In order to boost the utilization of these high-deductible health insurance plans, employers are providing more support to workers to educate them on all of their health coverage options. Tools are being used to better guide employees to the appropriate choice for their wellness and bottom dollar. Companies using these new tools have seen a rise in worker selection of the high-deductible plans.

Health payers interested in new payment models such as bundled payments, value-based care reimbursement, or the development of accountable care organizations are urged to work with employers to develop innovative solutions todayfs workforce is searching for.

Image Credits: Benefitfocus